The VC Stack Makeover: What Today's Funds Need - Webinar

The Seraf Compass

JULY 21, 2025

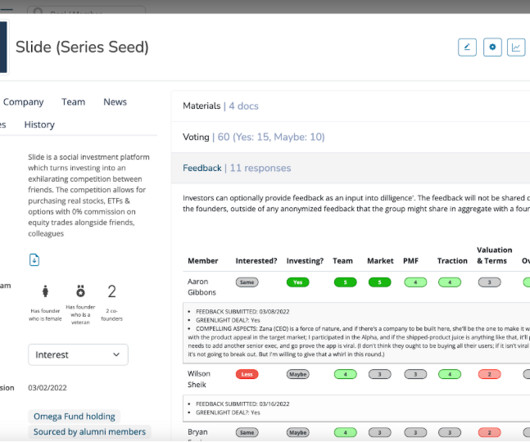

Early-stage investing is a high-context, low-resources game. Some teams streamline investor onboarding using Passthrough or Allocations Post-Investment Ops : This is where Seraf becomes the quiet engine, tracking IRR, KPIs, and cash positions, organizing documents, managing deadlines, and generating stakeholder-ready updates.

Let's personalize your content