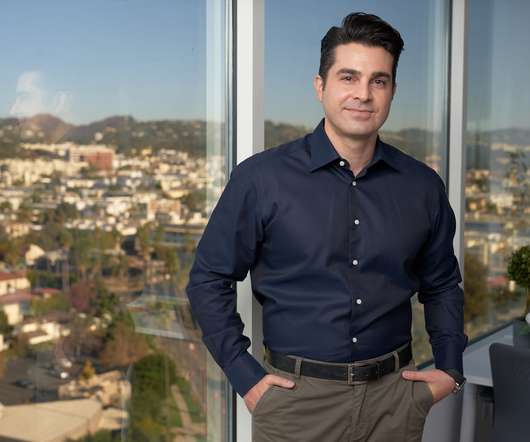

Spend management platform Teampay expands partnership with Mastercard, raises $47M

TechCrunch

NOVEMBER 30, 2022

Today, Teampay has hundreds of customers and significant venture capital financing behind it. “Enterprises crave control and visibility over the finances, and this not only helps the IT department, but [also] enables all departments to make better aligned business decisions,” he added. billion in 2021. This year, $1.6

Let's personalize your content