From Accelerators to Venture Capital: What is best for your startup?

Gust

MARCH 21, 2016

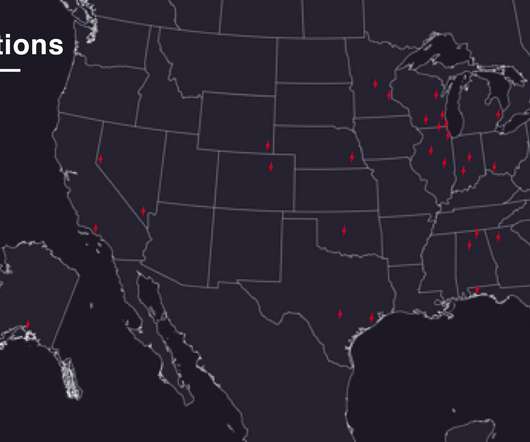

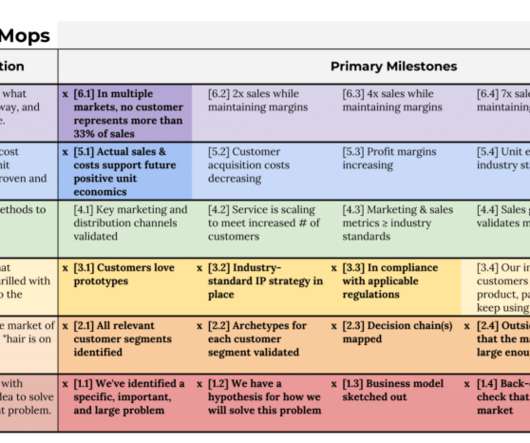

With startup growth up 61% since 2014 and more investment programs emerging, it can be overwhelming for founders to know just where to jump in. As the most startup-friendly accelerator on the planet, MassChallenge has helped 835 startup companies around the world, who have raised over $1.1 We have seen startups at. Read more >.

Let's personalize your content