Financial concierge startup Zeni banks $34M to show SMBs their finances in real time

TechCrunch

AUGUST 4, 2021

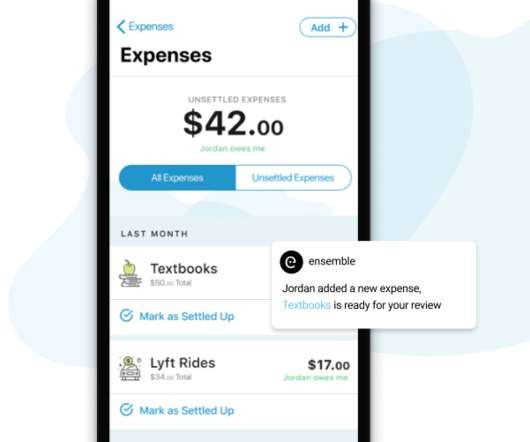

Zeni , a Palo Alto fintech company providing real-time financial services data to venture-backed startups, raised $34 million in Series B funding led by Elevation Capital. As part of the investment, Ravi Adusumalli, founder and managing partner at Elevation Capital, will join Zeni’s board. The company has now raised $47.5

Let's personalize your content