Listen Up! Why Revolution Ventures is Investing in Indianapolis-based Casted

Revolution

APRIL 6, 2021

By Revolution Ventures Managing Partner David Golden and VP Alex Shtarkman As voracious consumers of podcasting content, we could not be more excited to announce our investment in Indianapolis-based Casted , a company reinventing the traditional digital content marketing playbook. Stay tuned! [1]

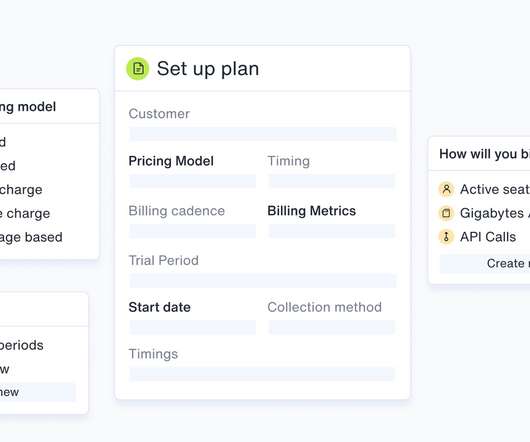

Let's personalize your content