Shield Capital’s Inaugural Venture Capital Fund Focuses on Frontier Technologies

American Entrepreneurship

OCTOBER 18, 2023

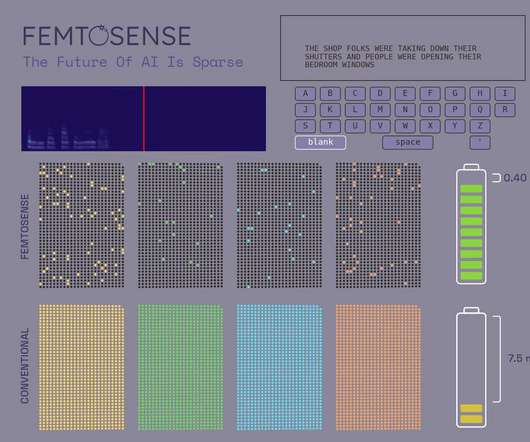

30 Investments to date in the areas of AI, autonomy, cybersecurity and space Shield Capital was launched in 2021 by the Managing Partners Philip Bilden and Raj Shah, both of whom have deep experience in technology and investing, driving their passion to support founders of frontier technologies.

Let's personalize your content