Real estate investing giant Fundrise breaks into venture capital

TechCrunch

JULY 18, 2022

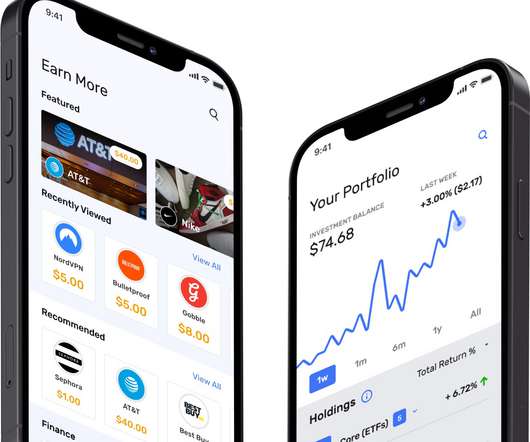

Investing in private markets has long been reserved for the ultra-rich. Ben Miller founded Fundrise in 2012 to give retail investors access to the private real estate market, and the company has since become one of the top 20 investors by size in that space, Miller, who serves as CEO, told TechCrunch in an interview.

Let's personalize your content