How Venture Funding For Early-Stage Startups Will Change During the COVID-19 Crisis

Dream It

APRIL 12, 2020

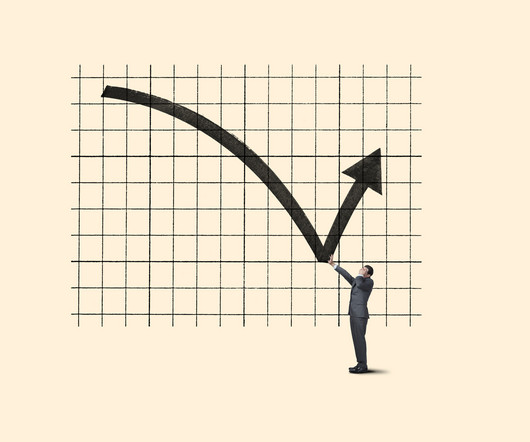

Paul Martino, General Partner at Bullpen Capital. During our recent Dreamit Kickoff week, Bullpen Capital Founder and General Partner Paul Martino ( @ahpah ) spoke with our Spring 2020 cohort about the state of the VC ecosystem in the current economic crisis. Will a financial crisis affect how venture funds deploy capital?

Let's personalize your content