A $30B Software Company from a $15m Investment

Tomasz Tunguz

DECEMBER 26, 2022

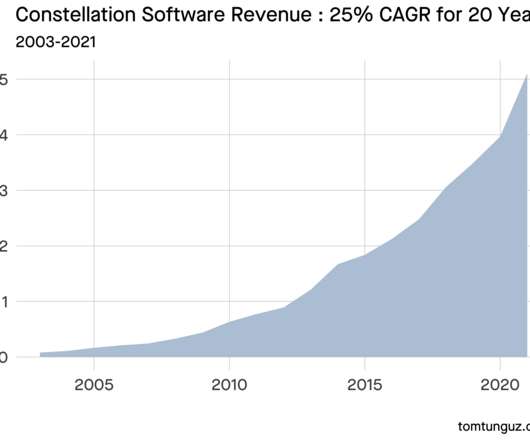

A former venture capitalist, Mark Leonard started Constellation in 1995 with $15m of outside investment & a goal of buying vertical software companies with a moat & good unit economics. From 2003 to 2014, Constellation’s revenues compounded from $80m to more than $5b, an average of 25% annually. . # of BUs. %. >

Let's personalize your content