The Entrepreneurial Path: Essential Tips for First-time Founders

American Entrepreneurship

JANUARY 21, 2025

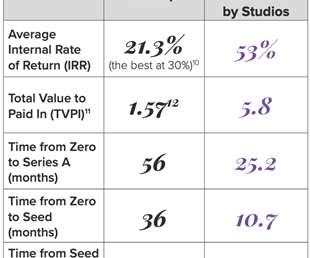

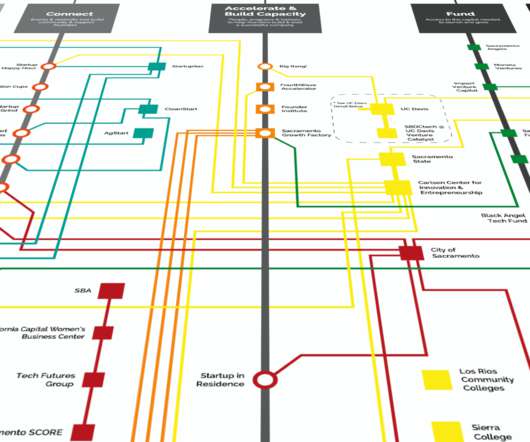

Equally important is knowing sources of capital such as bootstrapping, prospective investors such as angel investors, or venture capital if necessary, that can be tapped into at the various stages of a startups growth. Create a financial plan, and regularly monitor your revenue, expenses, and profit margins.

Let's personalize your content