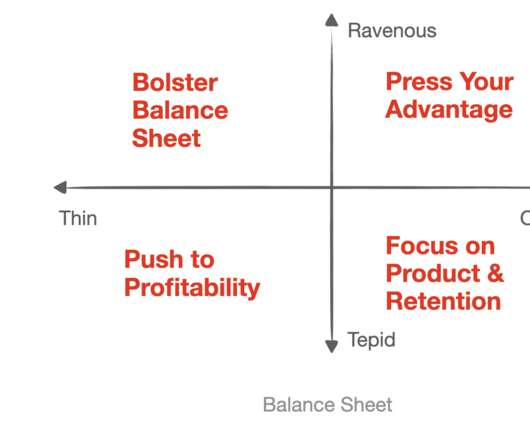

Our Investment Framework Post-COVID-19

500

JUNE 9, 2020

The post Our Investment Framework Post-COVID-19 appeared first on 500 Startups. From taking all aspects of our accelerators digital (including our Demo Day) to rethinking the opportunities of the future, we’ve taken this moment to analyze what innovations can come from this time and new opportunities that arise from our changing environment.

Let's personalize your content