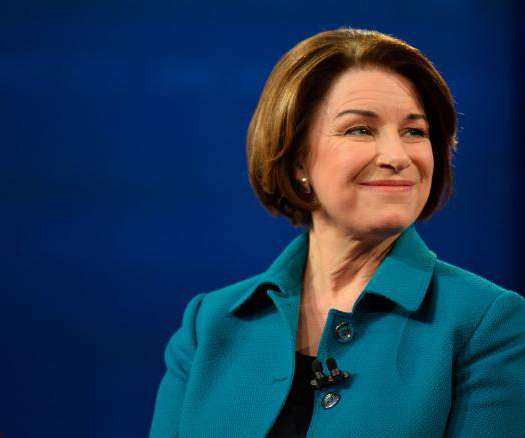

60 Top Women-led Venture Capital Firms

American Entrepreneurship

MARCH 7, 2024

billion of total venture capital. List of 60 Top Women-led Venture Capital Firms The following includes venture funds founded by women or those that have a focus on funding women-founded or gender-mixed startups and early-stage companies. According to the PitchBook data, in 2022 U.S.-based

Let's personalize your content