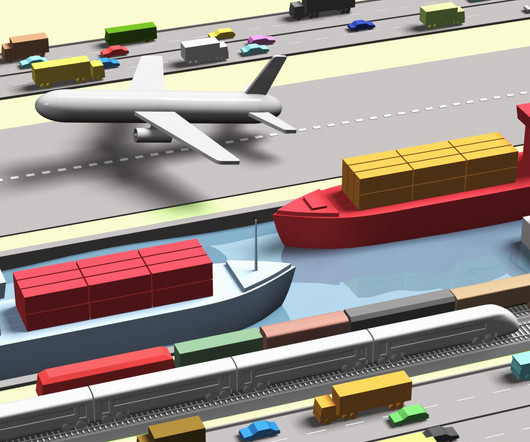

The next wave of supply-chain innovation will be driven by startups that help incumbents win

TechCrunch

JUNE 23, 2022

Steve Sloane is a partner at Menlo Ventures where he invests in inflection-stage companies. For years, the prevailing narrative for innovation in supply chain has focused on the disruptors: Upstarts that enter the industry with new technologies and business models to displace incumbents. and Enable. Steve Sloane. Contributor.

Let's personalize your content