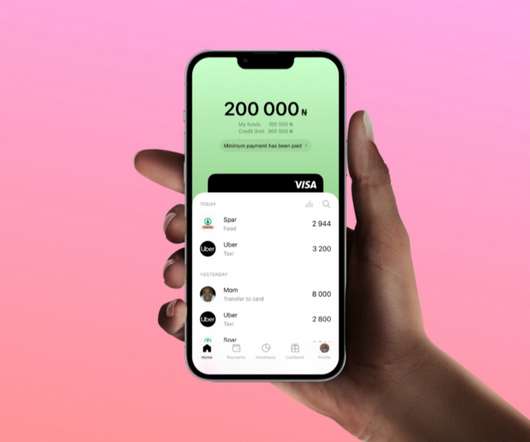

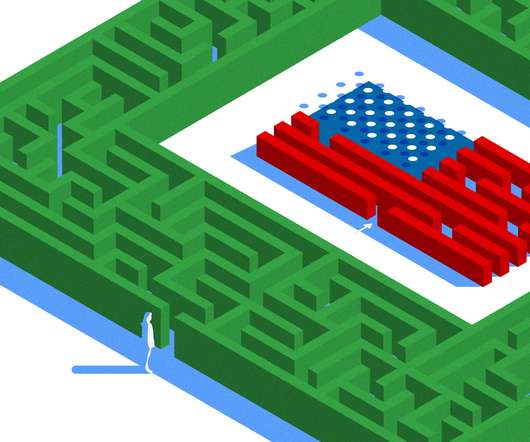

Fintech outperformed the market in 2021, and it’s set to do even better

TechCrunch

FEBRUARY 1, 2022

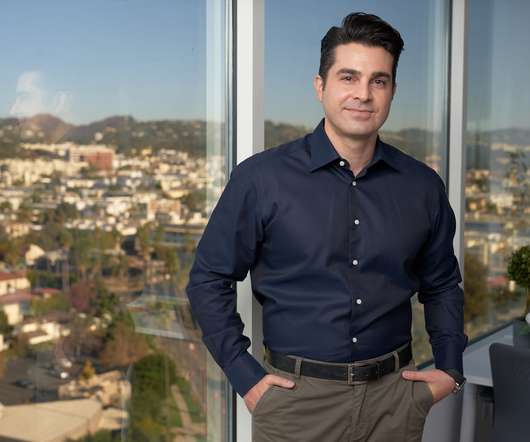

The former commercial chief (Product, Sales and Marketing) at PayPal, he now leads fintech investing at Matrix Partners, where he also invests in consumer marketplaces and enterprise software. Fintechs could see $100 billion of liquidity in 2021. Private markets followed public markets in making 2021 a record-setting year.

Let's personalize your content