What Does the Post Crash VC Market Look Like?

Both Sides of the Table

SEPTEMBER 15, 2022

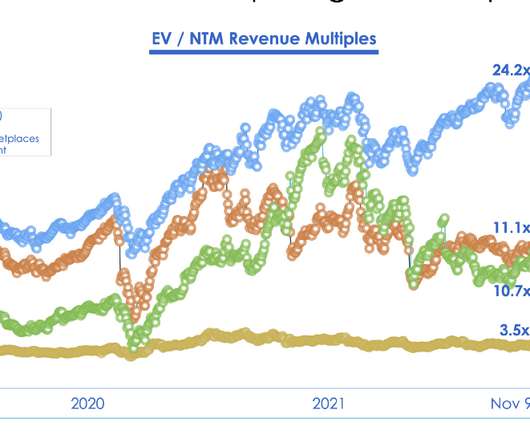

Should SaaS companies trade at a 24x Enterprise Value (EV) to Next Twelve Month (NTM) Revenue multiple as they did in November 2021? Even then private market investors can paper over valuation changes by investing at the same price but with more structure so it’s hard to understand the “headline valuation.” What is a VC To Do?

Let's personalize your content