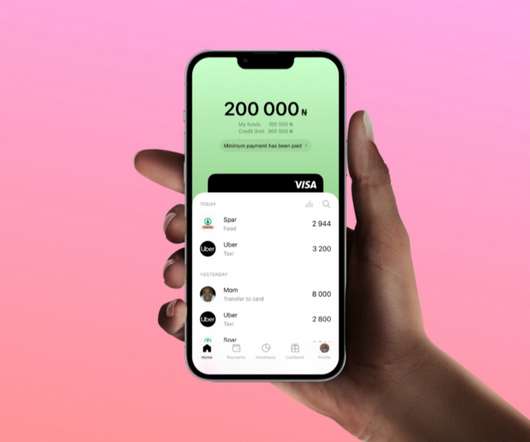

Israeli fintech Personetics raises $85M for tools to help incumbents personalize banking services to compete with neobanks

TechCrunch

JANUARY 19, 2022

Today a startup that is building tools to help incumbent address this challenge is announcing a round of funding on the back of a lot of demand for its services. It has also been on a fundraising run, with this round adding up to $160 million raised since the start of 2021. That’s a common thing.”

Let's personalize your content