Capital is a commodity

TechCrunch

DECEMBER 23, 2021

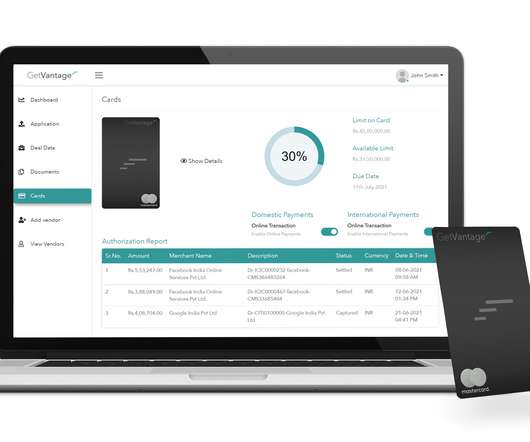

He leads the group’s venture capital fund, Seedstars International, which invests in seed-stage startups across emerging markets. Even after the unprecedented year that we had in 2020, the VC markets picked up in 2021 and founders raised 157% more capital in the second quarter of 2021 compared to the previous year.

Let's personalize your content