On Bubbles … And Why We’ll Be Just Fine

Both Sides of the Table

JUNE 22, 2011

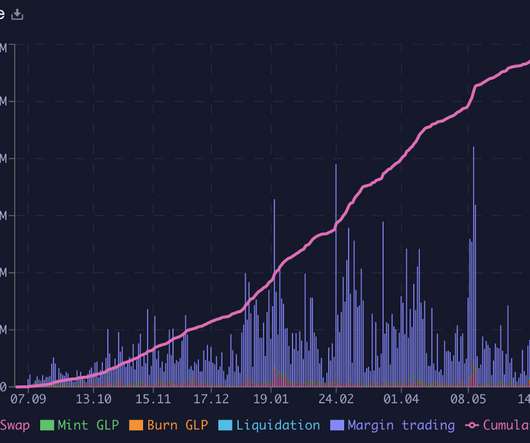

I know that most people who are close to them tend to deny their existence, as we saw in the great housing bubble of 2002-2007 and the dot com bubble of 1997-2000. To anybody who asks my advice I repeat the same line, “I don’t know whether this party will last 6 weeks, 6 months or 18 months. source: Capital IQ.

Let's personalize your content