15 Innovative Pitch Deck Designs That Drove Investor Engagement

StartupNation

JUNE 4, 2025

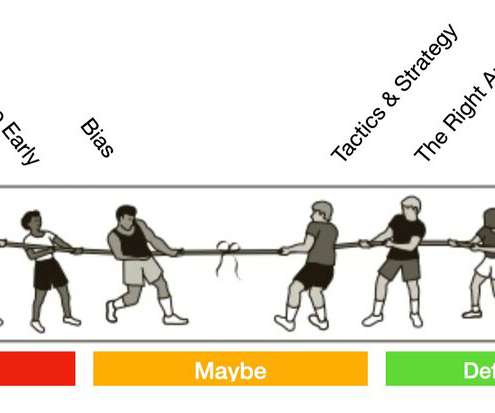

Discover the secrets to transforming pitch decks into compelling investor magnets, courtesy of seasoned industry professionals. I’ll never forget presenting to a particularly skeptical VC who kept questioning our projections. That order carried more weight than traditional pitch sequencing. That was no coincidence.

Let's personalize your content