The Veteran Fund Announces Oversubscribed Fund and $100K Competition Winner

American Entrepreneurship

DECEMBER 4, 2024

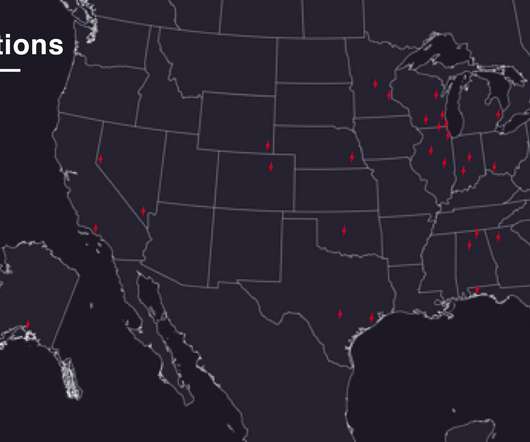

Recognizing this, The Veteran Fund announced the winner of its $100,000 Veteran Pitch Competition and the recent closing of its inaugural oversubscribed investment Fund I. Head of Global Operations of The Founder Institute, the world’s largest pre-seed startup accelerator, and the Co-Founder & COO of the Vet-Tech Startup Accelerator.

Let's personalize your content