Singaporean Fintech Enabler FLUID Raises $5.2M to Revolutionize B2B Purchase Financing

AsiaTechDaily

FEBRUARY 28, 2024

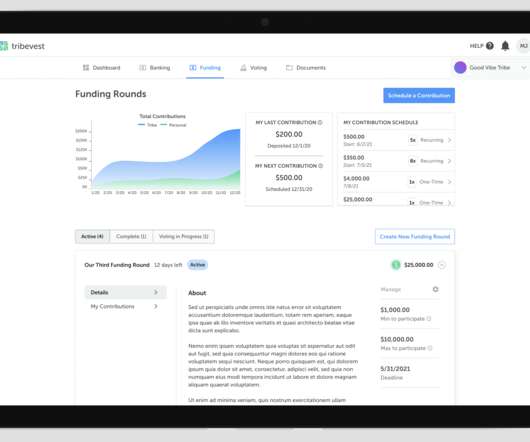

Singaporean fintech enabler Fluid has successfully raised $5.2 million in Series A funding, spearheaded by Insignia Ventures Partners. The funding aims to strengthen Fluid’s business-to-business purchase financing solutions. This latest investment follows […] The post Singaporean Fintech Enabler FLUID Raises $5.2M

Let's personalize your content