Views on the Ground: Scenes from Our Chicago Founder Fly-In

Revolution

JUNE 26, 2025

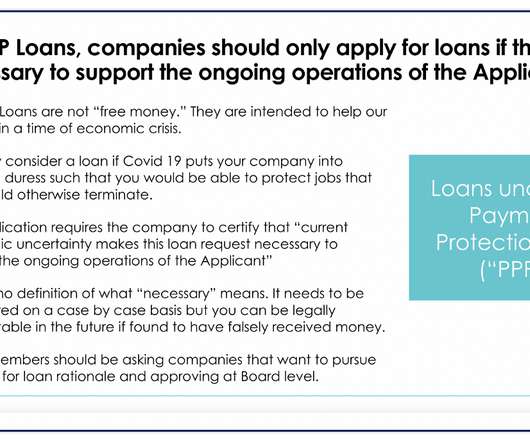

Portfolio company leaders from across the country touched down in the Windy City to connect with fellow Rise of the Rest-backed founders on tactical tools for turbulent times. VP of Platform and Portfolio Success, Amira Ouji, and Head of Community, Liz Westhouse, recap the event below. That outlook shaped the conversations that followed.

Let's personalize your content