Tola Capital, investing in AI-enabled enterprise software, closes largest fund at $230M

TechCrunch

NOVEMBER 29, 2023

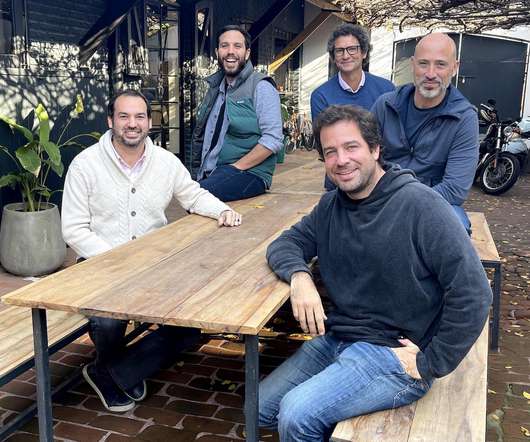

Tola Capital, investing in AI-enabled enterprise software, is the latest venture capital firm to announce its new fund, securing $230 million in capital commitments for its third fund, raising the largest amount to date. It’s been a great couple of weeks for new VC funds. Tola joins firms like NXTP, …

Let's personalize your content