NJEDA Establishes Diversity Finance Advisory Board

American Entrepreneurship

SEPTEMBER 22, 2023

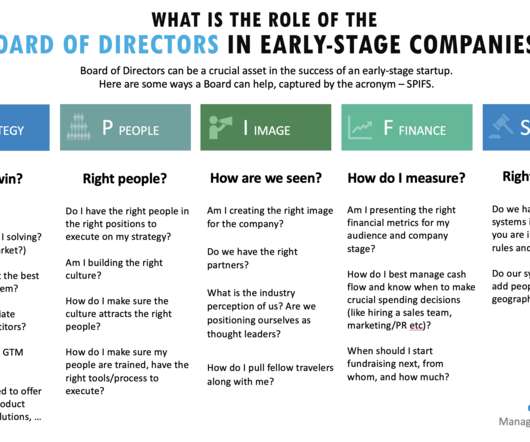

Board will work to increase capital to minority-owned startups, create diverse innovation economy WOODBRIDGE, N.J. The board will provide knowledge, guidance, and insights on ways to best increase capital, access, and investments in New Jersey’s diverse entrepreneurs. Harmon, Sr.,

Let's personalize your content