Half Of All VCs Beat The Stock Market

A VC: Musings of a VC in NYC

MAY 5, 2021

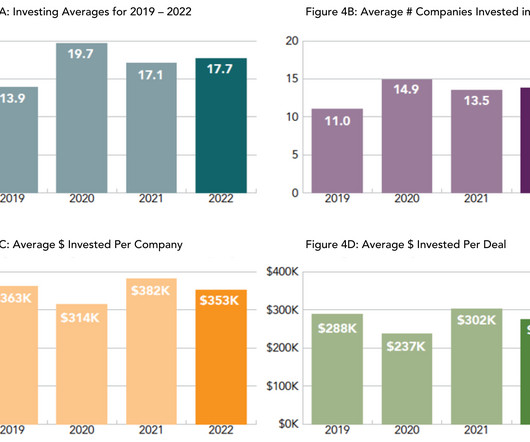

There has been this narrative about investing in VC funds that you have to get into the top quartile (25%) or possibly the top decile (10%) in order to generate good returns. I have heard that for as long as I have been in VC and probably have written it here a few times. As you can see, investing in VC funds can be very profitable.

Let's personalize your content