Venture capital probably isn’t dead

TechCrunch

AUGUST 6, 2021

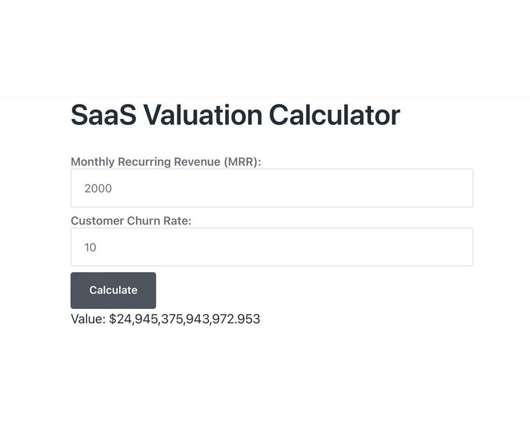

Venture capitalists are chatting this week about a recent piece from The Information titled “ The End of Venture Capital as We Know It.” Higher-than-average investment risk meant that returns from winning bets had to be very lucrative, or else the venture model would have failed. They got better.

Let's personalize your content