“Putting adVenture back into Venture Capital!”- Jeshua Soh’s Unique Approach to Investing

AsiaTechDaily

NOVEMBER 16, 2023

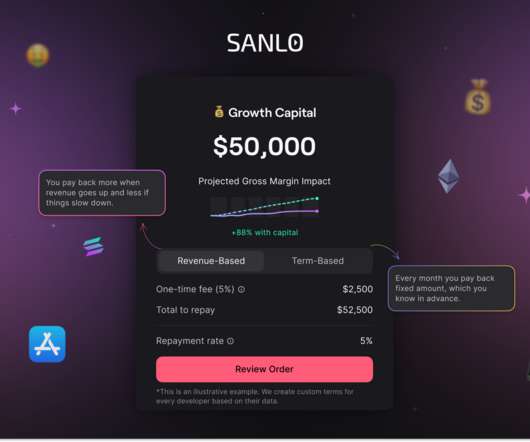

His focus on higher growth rates in developing markets aligns with the belief in the power of compounding interest. For founders opting for VC funding, swift closure of funding rounds is advised to maintain focus on product development. If opting for VC funding, close funding rounds swiftly to maintain focus on product development.

Let's personalize your content