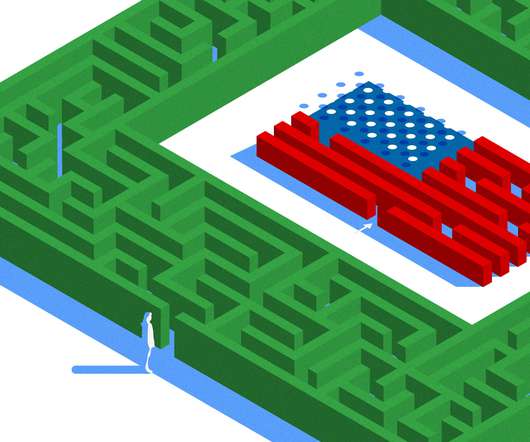

The “secret” side door into any investor

Paul G. Silva

DECEMBER 21, 2023

When a startup founder is trying to raise money, they know they should use referrals to get introduced to investors. Even if you get to talk to an investor in your network, investors tend to be cynical as heck. Contact them and ask for advice. Leverage your network if you can, but cold-call if you must.

Let's personalize your content