BE 2.0: Focus on Responsibility, Not Tasks – The Mindset Shift That Changes Everything

Paul G. Silva

APRIL 1, 2025

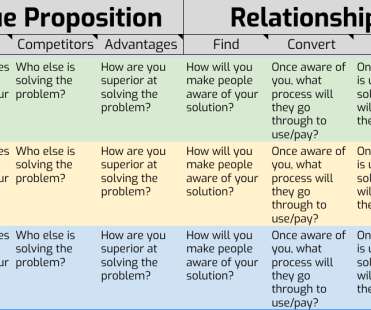

This post is part of my ongoing series exploring lessons from Jim Collins’s book, BE 2.0 (Beyond Entrepreneurship 2.0). Beyond the To-Do List In BE 2.0, Collins draws a critical distinction that transforms how we approach work: Tasks are things you do; responsibilities are outcomes you own. This ties in nicely with a concept I often teach my students about Features vs Benefits.

Let's personalize your content