What Happened In 2020

A VC: Musings of a VC in NYC

DECEMBER 31, 2020

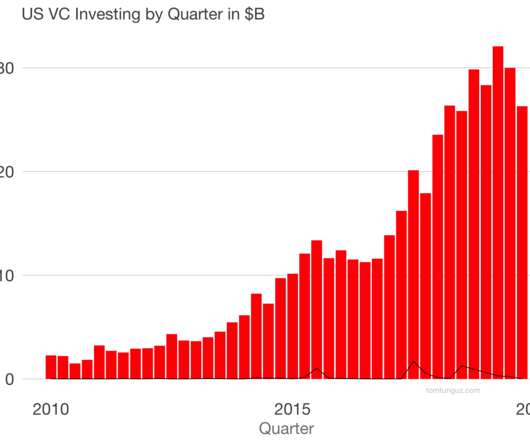

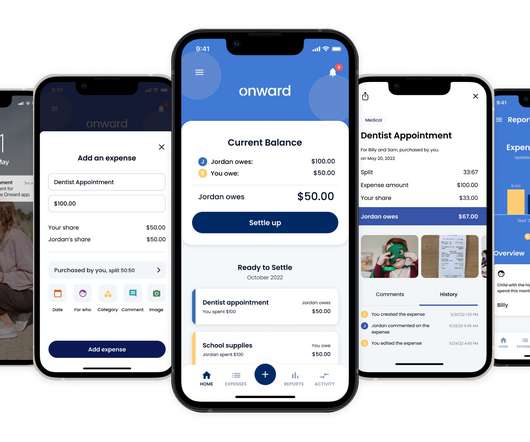

So today, I will write about 2020 in the context of tech/startups/VC/crypto. 3/ Technology based commerce solutions gain when less people venture into stores to buy groceries, clothes, and other consumer products. And they finance the trend that they are directionally correct about. That’s just how things are.

Let's personalize your content