13 VCs talk about the state of robotics investing in 2023

TechCrunch

APRIL 13, 2023

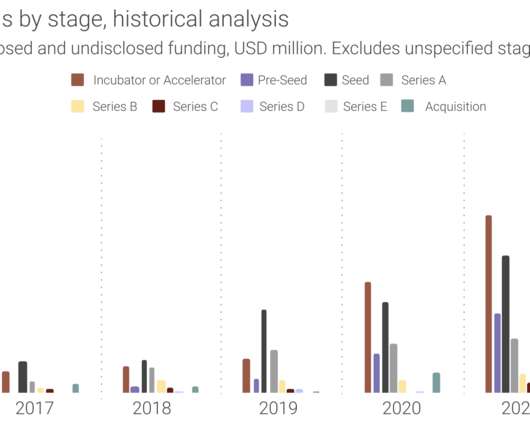

Amazon’s unending drive to outflank the rest of the world birthed an industry with its 2012 acquisition of Kiva. Investments began flooding into robotics around this time. Slowed investments have been compounded by continued economic woes and the recent bank collapses have further shaken confidence.

Let's personalize your content