Revenue-based financing: The next step for private equity and early-stage investment

TechCrunch

JANUARY 6, 2021

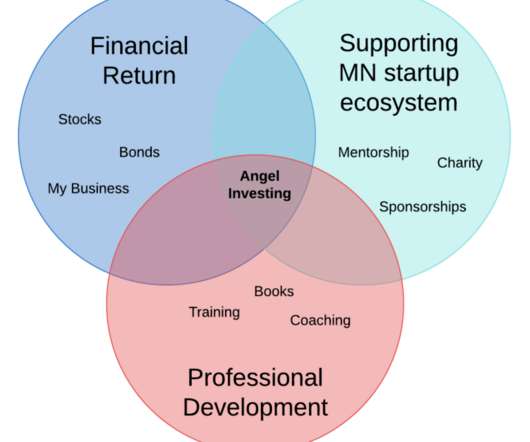

Thomas Rush is founder of Bootstrapp and Head of Investment Platform at ConsenSys Mesh. Revenue-based investing ( RBI), also known as revenue-based financing, or revenue-share investing, 1 is a natural next step for the private equity and early-stage venture investment industry. Share on Twitter.

Let's personalize your content