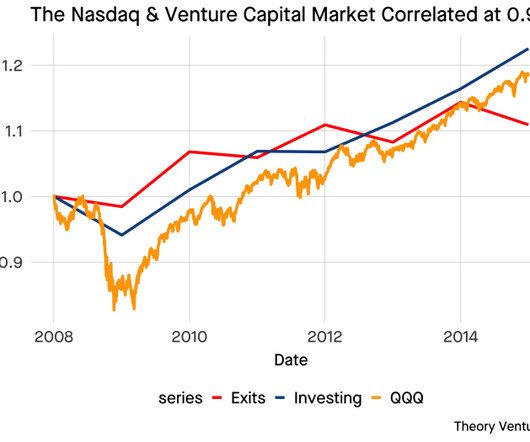

How Will a Venture Capital Recovery Feel? Observations from 2008

Tomasz Tunguz

AUGUST 6, 2023

What will a venture capital turnaround feel like? In 2008, I had just become a venture capitalist. In Q4 2009, Amazon acquired Zappos for $1b. Will it be gradual or sudden? What will change the sentiment in the market? Three months later, Lehman fell & the Global Financial Crisis started. at $1.5b.

Let's personalize your content