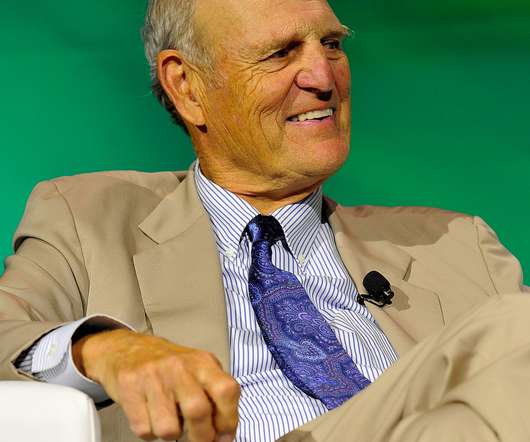

The Venture Investment Guide: Insights from Enlight Venture’s Yongmin Kim’s Illustrious Career

AsiaTechDaily

OCTOBER 20, 2023

Register Venture investment is a high-stakes game that demands vision, persistence, and adaptability. Although venture capital is often viewed as a maze, there are those who have paved the way, making the journey smoother for others. Despite the prevailing economic chaos, Mr. Kim embraced the challenge with fervor.

Let's personalize your content