Sylndr, an online used-car retailer, raises $12.6M pre-seed to disrupt Egypt’s automotive market

TechCrunch

MAY 23, 2022

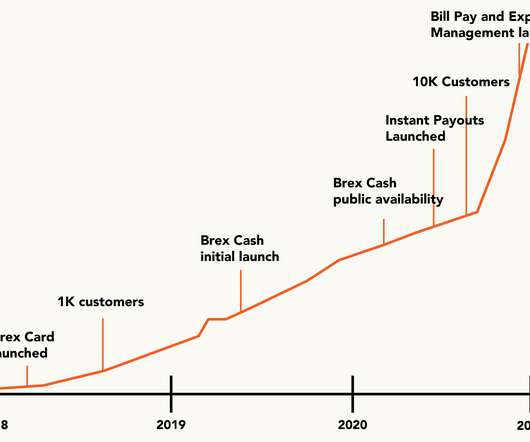

Recently, there’s been rapid digitization of this market , with several startups upending incumbents such as classifieds and hoping to define the new era of used-car-sale platforms. Saudi-based early-stage venture capital firm RAED Ventures led the round. Almajdouie, the managing partner at RAED Ventures, in a statement.

Let's personalize your content