Here is How to Make Sense of Conflicting Startup Advice

Both Sides of the Table

AUGUST 30, 2014

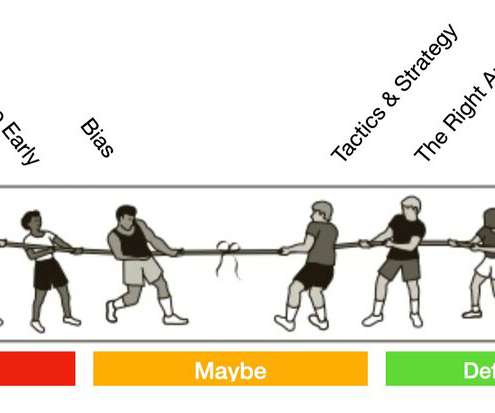

Everybody has a blog these days and there is much advice to be had. Many startups now go through accelerators and have mentors passing through each day with advice – usually it’s conflicting. There are bootcamps, startup classes, video interviews – the sources are now endless. What is a founder to do?

Let's personalize your content