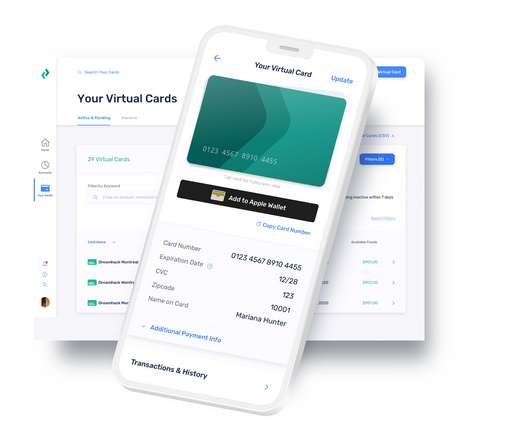

Citi backs Crowdz, a Pipe competitor that just raised $10M for its blockchain-powered invoice financing marketplace

TechCrunch

MAY 11, 2022

That player, Crowdz , recently secured $10 million in financing co-led by Citi and Dutch growth equity firm Global Cleantech Capital, with participation from Bold Capital Partners, TFX Ventures and Augment Ventures. Put simply, Crowdz started out by giving small and medium-sized businesses a way to sell invoices for financing to funders.

Let's personalize your content