The Future of Corporate Venture Capital

500

OCTOBER 25, 2019

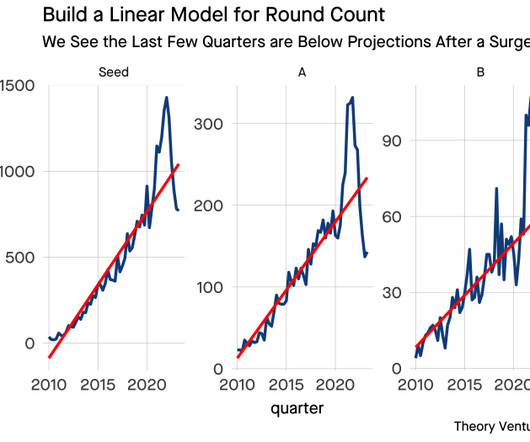

How has corporate venture capital changed? Conventional wisdom dictated that incumbents should focus their innovation efforts on R&D and growing their cash cows while investing in a few startups. But the rate of change has accelerated and with it, the balance of internal versus external investment.

Let's personalize your content