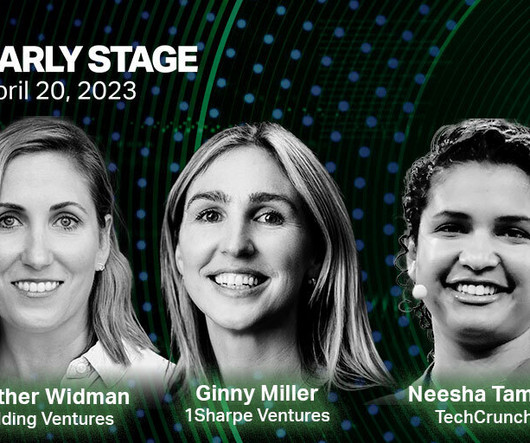

How To Pitch A Real Estate Tech VC

Dream It

MARCH 6, 2020

Berman comes from a real estate background, and he co-founded Camber Creek after realizing an opportunity to “create a double alpha situation,” both investing in high-growth startups and using those startups to improve the operations of his own real estate portfolio. Does the founder know how to sell into real estate?

Let's personalize your content