Groundfloor steps up its real estate debt crowdfunding platform with fresh capital

TechCrunch

FEBRUARY 21, 2022

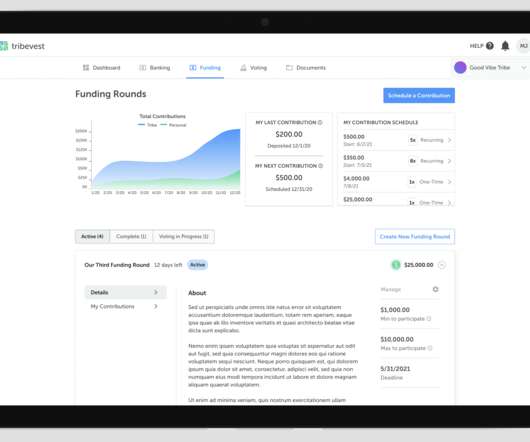

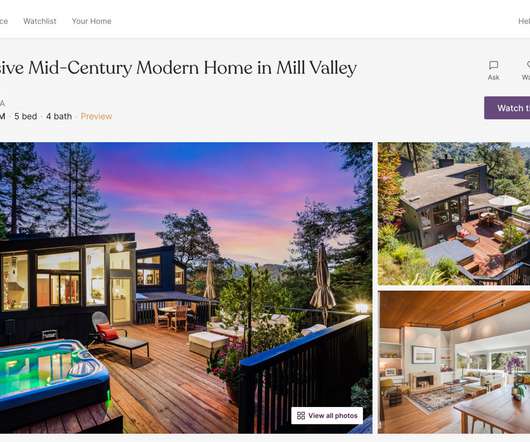

Groundfloor , the first real estate crowdfunding platform to gain regulatory approval, announced today that it raised its first round of institutional capital since 2015. Brian Dally, a former mobile network exec, and Nick Bhargava, a co-author of the bipartisan JOBS (Jumpstart Our Business Startups) Act, founded Groundfloor in 2013.

Let's personalize your content