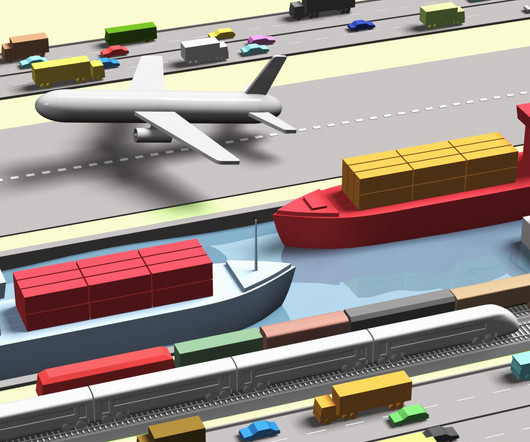

The next wave of supply-chain innovation will be driven by startups that help incumbents win

TechCrunch

JUNE 23, 2022

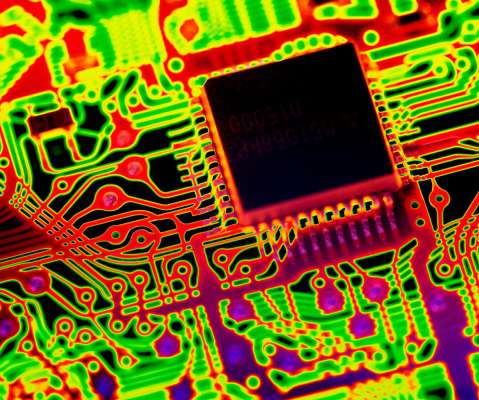

Steve Sloane is a partner at Menlo Ventures where he invests in inflection-stage companies. Derek Xiao is an investor at Menlo Ventures focused on soon-to-be breakout companies at the inflection stage. For these industries, digital enablers, rather than disruptors, constitute the next wave of supply chain innovation. and Enable.

Let's personalize your content