Venture capital probably isn’t dead

TechCrunch

AUGUST 6, 2021

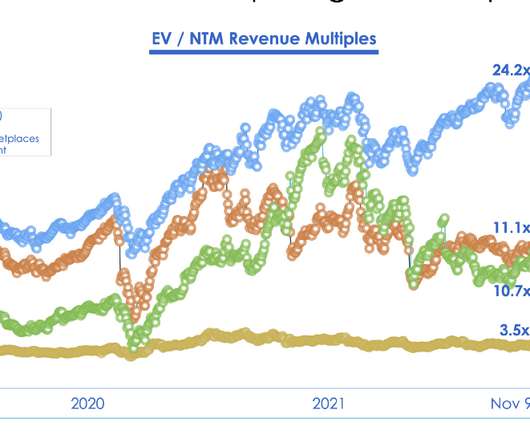

Venture capitalists are chatting this week about a recent piece from The Information titled “ The End of Venture Capital as We Know It.” A capital explosion. Lessin notes that venture capitalists once made risky wagers on companies that often withered away. Its author, Sam Lessin , makes some pretty good points.

Let's personalize your content