What Happened In 2020

A VC: Musings of a VC in NYC

DECEMBER 31, 2020

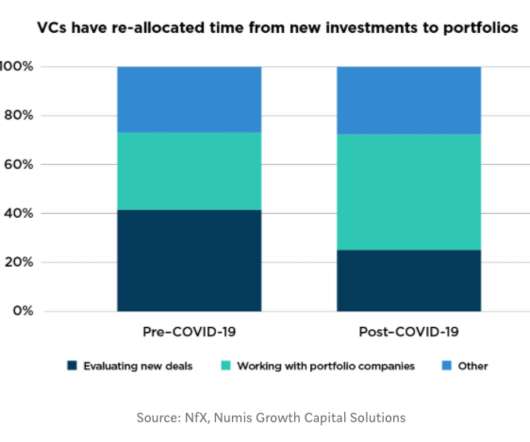

So today, I will write about 2020 in the context of tech/startups/VC/crypto. One of the big ahas of 2020 was how much time and productivity is wasted on commuting and how much more productive we have all become without it. And they finance the trend that they are directionally correct about.

Let's personalize your content