How Attractive is Risk Today?

Revolution

DECEMBER 13, 2023

Investing is similar. The below analysis outlines an approach to quantify the attractiveness of investing in commercial real estate at a given point. Howard Marks — the co-chairman of Oaktree — released a book in 2011 called The Most Important Thing. Such hard data can increase investment conviction when either is tempting.

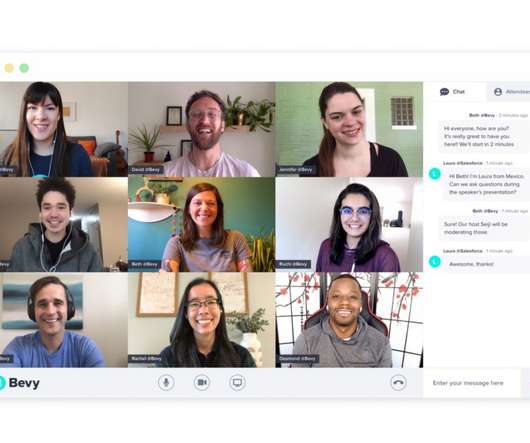

Let's personalize your content