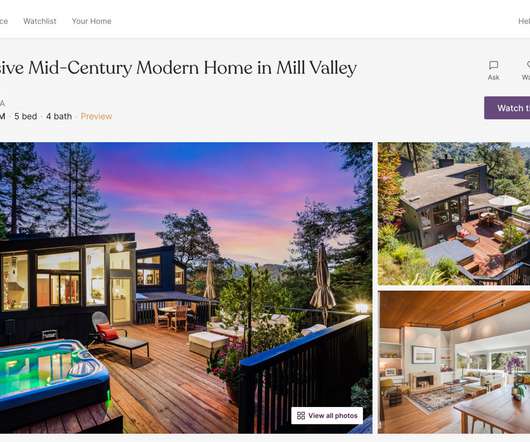

How To Pitch A Real Estate Tech VC

Dream It

MARCH 6, 2020

Jeff Berman is General Partner at Camber Creek , one of the first venture funds dedicated to real estate technology and the built world. The team owns, operates and manages over 150 million square feet of real estate, making Camber Creek one of the biggest value-add venture partners for real estate tech startups.

Let's personalize your content