Dispatches from the Road: Q3 2023

Revolution

OCTOBER 25, 2023

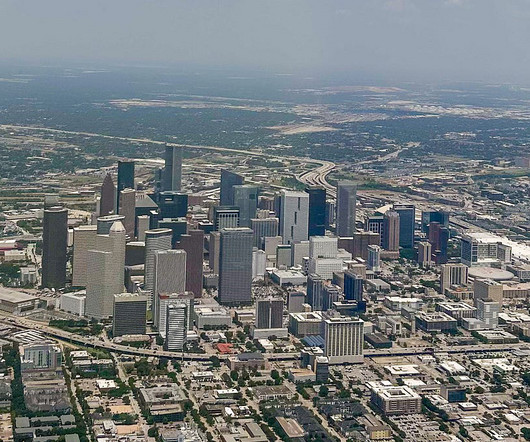

We’ve read plenty of articles on the movement of tech talent and the surge of American entrepreneurship , but seeing that momentum in person is a different kind of invigorating. Here’s a snapshot of the stops and connections we made in Q3. Where we went: Houston, TX? Where we went: Bozeman, MT?

Let's personalize your content