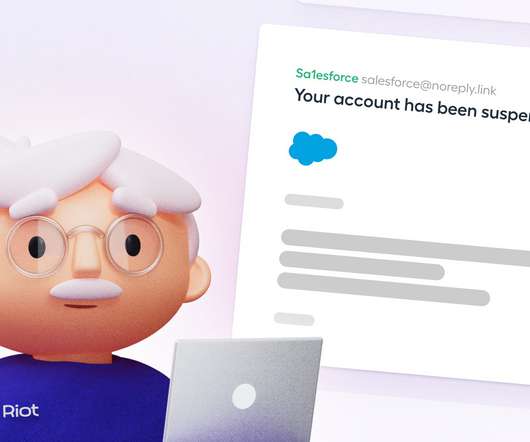

Riot prepares your team against highly sophisticated cyberattacks

TechCrunch

FEBRUARY 7, 2023

French startup Riot has raised a $12 million Series A round to iterate on its all-in-one cybersecurity awareness platform for businesses and their employees. The startup originally focused on fake phishing campaigns. Recently, the startup created a fun internal experiment that it doesn’t plan to release publicly.

Let's personalize your content