How to Win Consulting, Board, and Deal Roles with Private Equity and Venture Capital Funds

David Teten VC

JUNE 9, 2021

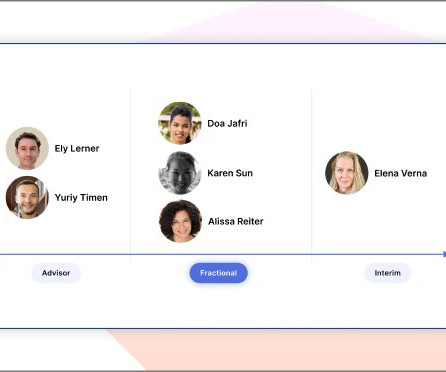

You can work as a consultant, an interim executive, a board member, a deal executive partnering to buy a company, an executive in residence, or as an entrepreneur in residence. . However, historically most private equity professionals were former investment bankers and other finance professionals. VentureDeal (free trial).

Let's personalize your content