Finding Founder-Market-Geography Fit

Revolution

NOVEMBER 28, 2023

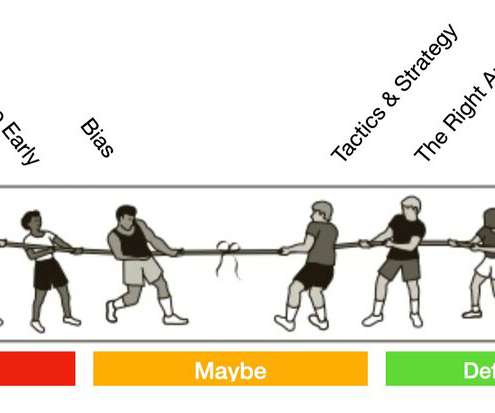

One is “tentpole company,” or a category-defining startup that helps put their hometown on the map, both for investors and future generations of founders. Internally, we’ve begun using the term “founder-market-geography fit” to describe this idea. What is Founder-Market-Geography Fit? Let’s get into it. Plastomics: St.

Let's personalize your content