Startup Investing: The New Trend in Alternative Assets

Onevest

APRIL 30, 2015

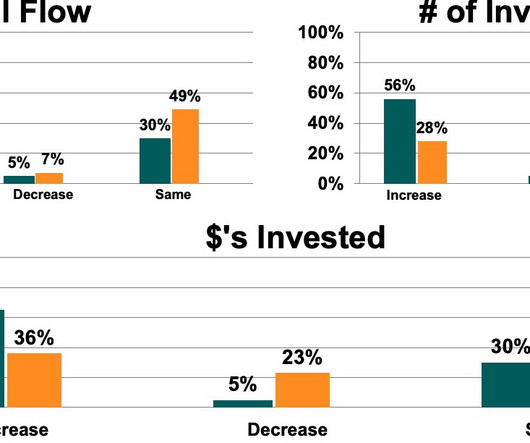

By definition Angel Investors are individual investors. But the data shows a rapidly growing trend in accredited investors investing together. This is something that we have experience at 1000 Angels , the private investor network that connects startups with investors. That means safety in investing.

Let's personalize your content